Why Invest in Hungarian Real Estate Funds? 🏡

The Real Estate market market in Europe is anticipated to reach a staggering value of US$174.50tn by the year 2024. Looking ahead, the market is expected to display a steady annual growth rate, specifically a Compound Annual Growth Rate (CAGR) of 3.02% from 2024 to 2029, resulting in a market volume of US$202.50tn by 2029 (source: Statista.com).

The Hungarian real estate market has emerged as one of Europe’s most attractive investment opportunities in recent years. Driven by consistent economic growth, urban development, and rising demand, Hungary offers a dynamic landscape for both domestic and international investors. With significant gains in property prices and a stable environment, real estate funds in Hungary provide an excellent vehicle for diversifying portfolios and securing long-term returns.

Real Estate Market Trends in Europe: Setting the Stage 🇪🇺

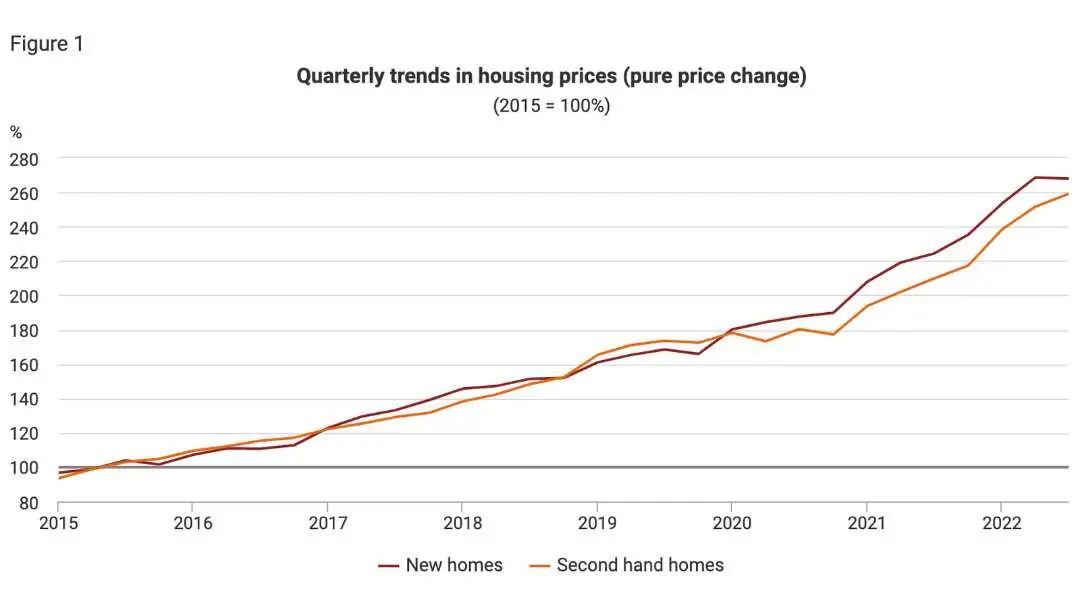

The European Union’s real estate market has demonstrated remarkable resilience and growth over the past decade. Between 2010 and the second quarter of 2024, property prices in the EU surged by an average of 52%, with rental prices increasing by 25%. These figures highlight the sector’s robust performance, even amid global economic challenges.

Within this context, Hungary’s real estate market has stood out for its exceptional growth trajectory. Property prices in Hungary have more than doubled since 2010, positioning the country as a regional leader in real estate development. While Western European countries may offer higher absolute price levels, Hungary’s market is characterized by affordability, rapid appreciation, and high rental yields, making it a compelling choice for investors.

The Case for Hungary: A Growing Real Estate Hub

Hungary’s strategic location in Central Europe, coupled with its stable economy and business-friendly policies, has made it a magnet for international investors. The country’s real estate sector has benefited from a variety of factors, including economic growth, infrastructure development, and increasing demand for residential and commercial properties.

Key Factors Driving Hungary’s Real Estate Market

Economic Stability: Hungary’s GDP growth has consistently outpaced the EU average, fostering a conducive environment for real estate investments.

Affordability: Compared to Western European markets, Hungary offers significantly lower entry costs while delivering comparable or higher returns.

Urbanization: Rapid urban development and a growing population in key cities like Budapest have fueled demand for housing and commercial spaces.

Foreign Investor Incentives: Hungary’s regulations facilitate foreign ownership of real estate, making it easy for international investors to participate in the market.

Spotlight on Budapest: The Epicenter of Growth 🚀

Budapest, Hungary’s capital, is the centerpiece of the country’s real estate boom. The city’s combination of historical charm, modern infrastructure, and economic dynamism has made it a top choice for investors. In the second quarter of 2024, property prices in Budapest rose by 3.9%, underscoring the city’s strong and consistent growth.

Key Insights into Budapest’s Real Estate Market

New-Build Sector: The average price for new apartments is approximately 1.5 million HUF/m² (~3,846 USD). High demand for modern, energy-efficient housing drives this sector.

Pre-Owned Properties: Pre-owned apartments average 963,000 HUF/m² (~2,469 USD), offering affordable options for investors seeking quick entry into the market.

Rental Demand: Budapest’s thriving tourism industry and growing expatriate community ensure a steady demand for rental properties, translating to attractive yields.

With a growing population and increasing international recognition, Budapest remains a hotspot for both residential and commercial real estate investments.

Opportunities in Regional Cities: Beyond Budapest 📍

While Budapest dominates the headlines, Hungary’s regional cities present untapped opportunities for savvy investors. Cities like Debrecen, Szeged, and Pécs have seen substantial infrastructure investments, driving economic growth and boosting real estate markets.

Regional Market Highlights

Affordable Entry: Property prices in regional cities are significantly lower than in Budapest, providing cost-effective opportunities for investors.

Steady Growth: Despite a slight dip in prices in Q2 of 2024, annual growth in these markets remains strong.

Diversification: Investing in regional cities allows investors to spread risk and capitalize on growth in emerging areas.

The Future of Hungarian Real Estate 🔮

The outlook for Hungary’s real estate market is overwhelmingly positive. Key drivers, such as economic growth, urbanization, and increasing foreign investment, are expected to sustain market momentum in the coming years. Areas surrounding Budapest and developing regional cities are particularly poised for growth.

Market Projections

Rising Demand: Hungary’s population growth and urban migration will continue to drive demand for housing and commercial spaces.

Sustainable Development: The growing emphasis on energy-efficient and sustainable buildings will attract environmentally conscious investors.

High Returns: Investors can expect a combination of capital appreciation and steady rental income, ensuring long-term profitability.

The Role of Real Estate Funds: Simplifying Investment

Real estate funds provide a streamlined and professionally managed way to invest in Hungary’s dynamic property market. These funds pool resources from multiple investors, enabling access to diverse properties and reducing individual risk.

Benefits of Investing in Real Estate Funds

Diversification: Gain exposure to multiple properties and locations, mitigating risk.

Professional Management: Experienced fund managers optimize investments for maximum returns.

Ease of Entry: Real estate funds eliminate the complexities of property ownership, such as maintenance and tenant management.

Liquidity: Many funds offer more liquidity than direct property investments, providing greater flexibility for investors.

Why Invest Now? Seizing the Opportunity 🚀

Hungary’s real estate market is at a pivotal moment. With property prices steadily rising and demand outpacing supply, investors who act now stand to benefit from significant capital gains and stable income streams. Whether you’re an experienced investor or new to the market, Hungary offers a unique combination of affordability, growth potential, and ease of entry.

Key Takeaways

1. Timing Matters: Early entry into Hungary’s growing market ensures maximum returns.

2. Strategic Location: Hungary’s position in Central Europe provides access to regional and global markets.

3. Proven Track Record: Historical data demonstrates consistent growth and high returns.

Conclusion: A Smart Investment Choice 📈

Hungary’s real estate market presents a compelling opportunity for investors seeking growth, stability, and diversification. With its dynamic economy, attractive property prices, and robust demand, the market is well-positioned for long-term success. By investing in Hungarian real estate funds, investors can leverage the expertise of professional fund managers and capitalize on one of Europe’s most promising markets.

Take advantage of this unique opportunity to grow your portfolio and secure a profitable future in Hungary’s thriving real estate sector.